This is Thanksgiving Weekend in the mighty U. S. of A, which is the biggest holiday travel day of the year and precedes the mighty "Black Friday" shopping event when crowds break down the doors at Apple stores across the country because a new version of battery charger will be on sale and includes a "way cool" screen-shield for the bottom basement price of $199.99. What a country!

I grew up in the 50s and 60s in the Great White North in a little town full of British immigrants whose very English, Irish, and Scottish accents were completely "Canadian" because when we hooligans got out of line, it was those mothers with their thick Edinburgh brogues and Dublin lilts that warned us of the outcome "when yer FAH-THUR gets 'ome."

Thanksgiving was a holiday, but it was held in October rather than November, and it was just another holiday. It was considerably less important for a sixteen-year-old who just got his driver's license than the May 24th Weekend — the grand celebration of the birthday of Queen Victoria of England — and for most young lads growing up in or near the city of Toronto, it was the mad dash up the 400 highway which, in those days, was four-lanes divided by a concrete barrier that guided us "up to the cottage." In the 1970s, it was not uncommon to see cars passing snub-nosed beers between vehicles as they raced northward to an infamous but memorable weekend of booze, bikini-chasing, sunburns, and debauchery of the highest possible order.

In 1972, I headed south across the border to the City of Saint Louis, Missouri, to a university campus surrounded by boundaries that included the second-worst ghetto

murder rate in the U.S. (behind Detroit at the time) on three sides and an interstate highway on the fourth. When I first arrived, I was more curious than concerned because I knew big cities because of my junior hockey days. I certainly knew "Toronto the Good" — the white-bread heart of Anglo-British North America. I knew — and loved — Montreal and Quebec City only because as much as the Quebecois hated the English-speaking Canadians in the 1960s and 1970s, they completely melted when a young "bloke" broke into high-school French in a restaurant or bar simply out of respect for the local language, which my mum taught me to do EVERY TIME I crossed the Ontario-Quebec border. However, as always, I digress. . .

As I settled into the dormitory known as Griesedieck Hall in the late summer of 1971, I had zero comprehension of the importance of the Thanksgiving Day Celebration, which is considered by the vast majority of the nation to be a "religious" holiday. As I was spending hour after hour in on-ice practices and weight rooms and climbing stairs at the Athletic Center, I could not grasp why the facility was vacant. It was U.S. Thanksgiving. I kept asking the few dormitory neighbors that were still around why the place was so dead on a weekend, and they looked at me like I had a third eye. Alberto Sanchez from Puerto Rico said: "It is like our Navidad."

The next year, I was dating a really lovely lady from "West County" St. Louis (who had an I.Q. of about 180) who invited me home to her "family Thanksgiving." The first celebration was — of course — pre-holiday Mass at the local church but then evolved into this intricate array of celebratory rituals that cast huge accolades to the deceased family, friends, and local citizens. She later explained to me that the Thanksgiving Holiday is a strictly American holiday and is not shared with the rest of the world.

I never forgot that first American Thanksgiving. It spoke volumes about the country, its traditions, and most importantly, its wonderful people. They worship this weekend for reasons that are close only to their memories, their families, and their hearts. Watching sons and daughters and nieces and nephews roll through the front door of that little house in "West County" as sleeping cots came up from basement storage while extra seats and tables were placed before the dinner arrived was — for me — a watershed moment in 1972 in understanding what defines the heart and soul of America. That has not changed, but it is so severely threatened.

Stocks

I am no longer the table-pounding bull I was in late October, but I have yet to turn completely bearish despite the overbought conditions that are now everywhere.

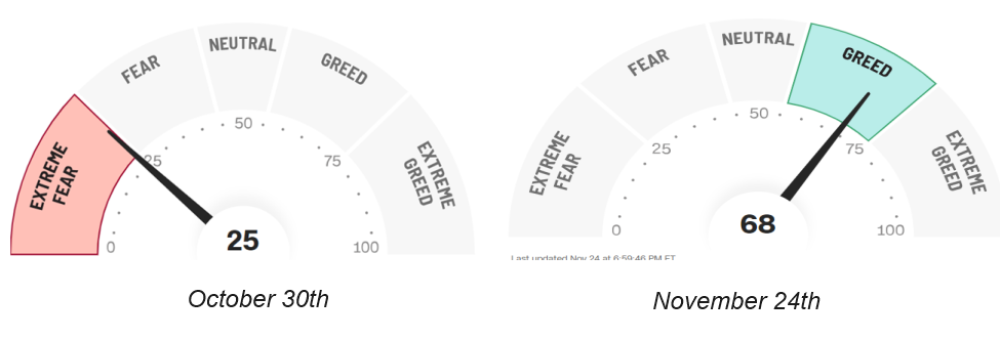

While the economic numbers are pointing to recession, the market momentum numbers are pointing to "new highs across the board," and for the S&P 500 (and its ETF cousin: SPDR S&P 500 ETF (SPY:NYSE), the 52-week intraday high is less than 1% away. Was it really only twenty-five days ago that I was posting a picture of the CNBC Fear-Greed Index with the needle buried in the <EXTEME FEAR> zone?

That contrarian needle has not gapped up into the <EXTREME GREED> zone (yet), but it is certainly pressing up toward it in a manner similar to the bottom where it nudged into the <EXTREME FEAR> zone rather than plunging down through it to a "1" reading like March 2020.

This time, there never actually were multiple sessions of capitulation like I saw at the lows in March 2020 or the top in January 2022. The rally that has taken the SPY:NYSE up over 11% in less than a month has seen the Relative Strength Index ("RSI") move like a Saturn rocket from an oversold 28.9 to an overbought 71.88. All momentum indicators that I follow are now in overbought territory, but that does not mean that stocks are going to roll over and head down into a Q4/2018 type of sell-off. Seasonality still favors the bulls, and since the vast majority of fund managers are still underweight equities with hedge funds still carrying hefty short positions (albeit far smaller than a month ago).

I took profits on the SPY December $425 calls bought in late October under $7 when they started to trade in the mid-$20s and scaled out into strength with the final tranche sold in the $28.50 range. They closed at $30.64 on Friday, making it one of the best trades of 2023 in terms of return on capital but also in terms of just how fast it happened.

One of the trades that actually fuelled the stock market rally was the call on the U.S. iShares 20+ Year Treasury Bond ETF (TLT:US), which was massively shorted by the hedge fund community right up until the third week in October, which was exactly the week I bought it.

Every article I was reading that week called for higher yields, including an interview with Rick Santelli, drawing a chart showing a 13% yield as an extrapolation of the 2023 rise looking out to 2025.

That came on the heels of JP Morgan CEO Jamie Dimon telling the world that we could see 7-8% Fed Funds if inflation failed to come into line. These ominously bearish forecasts contributed to the gloom-and-doom sentiment that prevailed by the end of October, so I did what usually — not always — works to a tee. I "faded" the prevailing unanimous sentiment and bought the TLT:US around $83 and a pile of December $83 calls, which have since doubled and look higher going into year-end as the economic data is starting to weaken.

There is a new narrative out there that says that the egregious U.S. deficit is going to require massive new issuance of Treasury bonds that will require higher and higher yields to attract buyers regardless of the macroeconomic outlook and Fed policy. No matter how weak the economy gets, the need for buyers will force yields to move up.

Many of the same people remaining short bonds and stocks and stocking up on gold and silver are betting heavily that "the Fed is trapped" (followed by ten exclamation marks), to which I say "Horsefeathers" (followed by ten exclamation marks). Until the U.S.S. Nimitz is refused credit at the local refit port, the Fed will continue to be the "buyer of last resort" because if there is one function of the Fed that will never change, it is funding the U.S. government.

For that reason, I see bond yields responding to the economic data and, more importantly, the perception that the financial system is becoming "shaky," which is the one condition that 2008 and 2020 taught us could never be tolerated. The Fed will manufacture credit with the snap of its fiscal fingers or the waving of its monetary wand, which means the stock and bond markets will continue to thrive.

Despite the fact that I have stepped aside from the SPY:NYSE trade, I expect higher prices by year-end, but I must confess that the November rally has stolen a great deal of thunder from December's perceived bullish outcome. RSI's above 70 are rarely optimal times to load up on anything that is stretched that far, especially with so many smug little smiling faces on CNBC these days. Whenever the Talking Heads begin fawning and fussing over each other and the "great calls" they made on Apple, Nvidia, or Microsoft, it is time to head for the exits.

Gold (and Silver)

Last week, I scaled back into my long call position (March expiry) after exiting at essentially the same level in late October, proving once again that there are times when one can overtrade a position. I was correct in the call — which was to sell in the $184-186 resistance zone — but what I failed to grasp was the latent buying power out there. Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE)

Gold dipped down into the triple convergence zone below $180, where all three moving averages were biding their time but stayed there for a sip or two of Timmy's coffee, then rocketed right back into the resistance band between $185 and now $186.33, closing out the week at $185.52. SPDR Gold Shares ETF (GLD:NYSE) is acting superbly, and I shudder to think what happens when it breaks out from that resistance zone, probably next week. The all-time intraday high was in August 2020 into the pandemic-driven stimulus orgy by the dynamic printing duo of the Fed and U.S. Treasury at $194.44 ($2,089 spot gold).

That was also the top for the gold mining stocks, but while gold bullion has acted like a champion and is now 2.23% off all-time highs, the gold miners have been down nearly 40% since that August 2020 peak. Now, it may just be that the gold miners are suffering from tax-related selling pressure, but I doubt it. Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) is down 42.4% from the August 2020 peak and acts as though it has an algorithm pounding on it during every rally attempt since the May regional banking crisis.

The bottom line is that something is seriously wrong when a producer of the quality of AEM with solid earnings and reserve growth gets trashed while carrying a debt-equity ratio of .11, while hundreds of zombie tech stocks with zero earnings and massive debt loads carry market caps that are multiples of AEM's.

On a valuation basis, the gold and silver mining stocks are ridiculously cheap, and it is my humble opinion that 2024 is going to be a stellar year for them. As the "story stocks" all get kneecapped in 2024 as economic growth wanes, the gold miners' balance sheets, with their modest debt levels, are going to be appreciated by the newly-found risk-averse portfolio managers.

From a technical perspective, I see a potential "slingshot effect" happening in late December, leading to big rallies after New Year's Day. The Senior Producers will lead the charge, but their smaller foot-soldiers will have spectacular moves as we get the long-awaited regression to the mean in gold miner valuations — and it should be clearly pointed out that I have not been a screaming cheerleader for the gold miners since I exited the GDX/GDXJ duo in the summer of 2020 after nailing the exact day — March 16, 2020 — that they bottomed.

As we approach the final trading month for 2023, I am on the record: The gold miners are approaching another "Generational Low" if they have not already had it in late September.

On Thursday, while my American friends were stuffing themselves with stuffing, I put out a note to subscribers with a few tasty morsels about Norseman Silver Ltd. (NOC:TSX.V; NOCSF:OTCQB), one of my favorite stocks for 2024, where some positive developments and appointments were recently announced.

Norseman management thinks as I do is best summed up in this note:

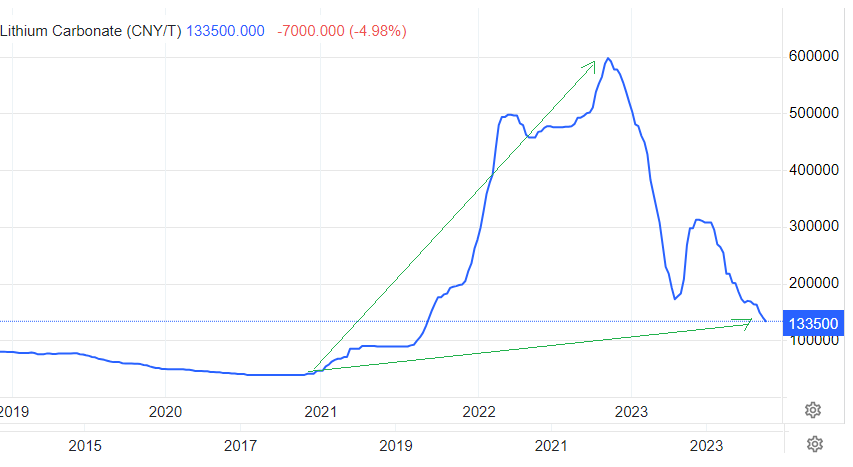

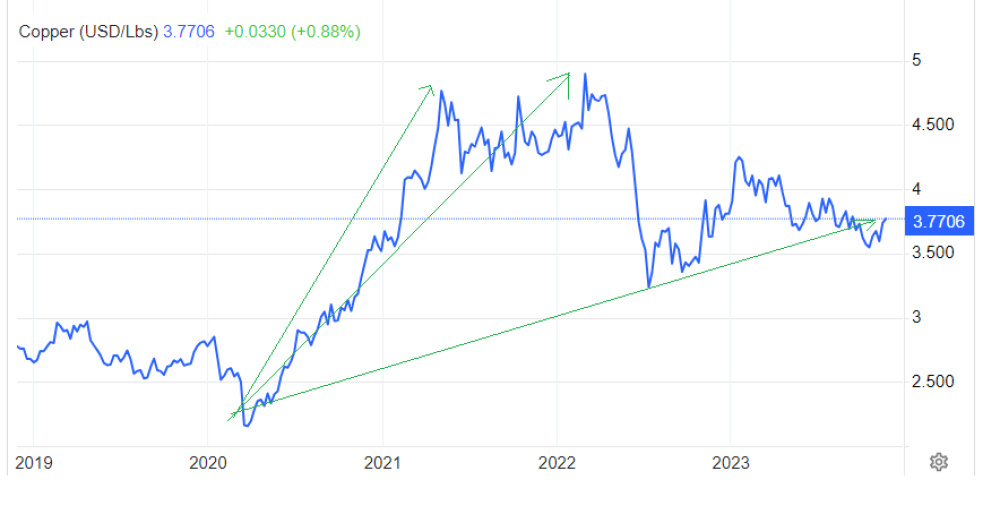

"I am on record as stating that my three favorite metals for above-average performance this decade are uranium, lithium, and copper. The first two have already experienced geometric advances in price since 2020, while copper is still lagging on the faulty narrative that supply is weighing down on price due to recessionary behavior in the Chinese economy. That is a false narrative.

Uranium is up over 400% in the last eight years and with fifty-seven different nuclear reactors under construction around the world, the future looks bright.

Lithium prices, while off their 2022 highs, have already experienced the bullish effects of "Electrification demand" and are expected to continue to advance into the balance of the decade.

The copper price had false starts into 2021 and 2022 as the pandemic-triggered shutdowns curbed global production, but those bottlenecks were unclogged in 2022 and 2023, leading to a correction that ended in late 2022.

Copper is now poised to replicate the exponential moves previously seen by its other two electrification brethren.

I believe that copper will be the stellar performer of the "Electrification Trilogy" in 2024, not because global growth is going to explode as we saw in the 2001-2011 Commodities Supercycle caused by the Chinese infrastructure build-out that lasted an entire decade. That period had a "demand-pull" effect on copper prices as the Chinese construction boom took off. The next half decade is going to have a "cost-push" effect on copper prices as old mines struggle with grade control while new mines are non-existent because new discoveries have remained dormant thanks to short-sighted environmental policies and bad planning. Increasing costs associated with new mine development will push the copper price northward.

Since the GFC in 2008, there has been a torrent of malinvestment that has largely shunned the mining industry, and no better example is the case for copper. While the NASDAQ and NYSE have hundreds if not thousands of technology names from which to choose, you can count the number of quality copper miners and explorers on two hands.

When the trillions of dollars, yuan, euros, and yen are finally unleashed upon the miners, there simply will not be enough of them. In 2018, there were relatively few lithium explorers; today, there are hundreds, and what prompted the rise was one thing: price. The advent of the electric vehicle caused an explosion in demand for the lithium-ion battery and, by default, lithium. The move to replace electricity derived from fossil fuels with nuclear is going to drive the three metals into the ionosphere. The one metal that has yet to feel the power of new demand is copper.

Junior exploration and development companies that are moving in the direction of copper are going to receive the same degree of affection being bestowed on the uranium names today and the lithium names in 2022.

Copper is next.

Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Norseman Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Norseman Silver Ltd. and Agnico Eagle Mines Ltd.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.